How Does Dental Insurance Work Rosenberg, TX

If you are in the market for dental insurance, you may be curious about how it works. Dental insurance plans come straightforward, and you can make an informed decision when selecting the right plan for your dental needs.

When you enroll in a dental plan, you enter into an agreement. Individuals who purchase a dental plan must pay monthly insurance premiums, along with any additional copays and deductibles that may be a part of their particular dental plan. The insurance company will pay your dentist for services covered at an agreed-upon reimbursement level.

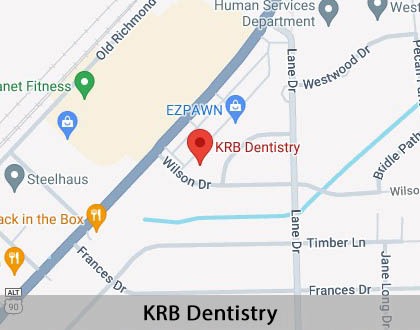

To determine whether or not KRB Dentistry accepts your dental insurance, call us at (832) 361-3929 to learn more. We are proud to serve patients in Rosenberg and the surrounding area.

Shopping for Dental Insurance

When shopping for dental insurance, it is essential to keep one's ideal provider in mind. After all, dental insurance can only get one so far if it leads them to the wrong dentist. If possible, patients should check each provider's directory of dentists within their network before choosing a plan.

This can usually be done online or over the phone. If the provider they want is not in a certain dental insurance carrier's directory, they can move on to the next insurance company. However, patients who are open to seeing a different provider may choose to shop around for another dentist.

“When shopping for dental insurance, it is essential to keep one’s ideal provider in mind.”

Coverage for Dental Procedures: Types of Coverage Available

Plenty of options exist for dental insurance. This can be good, as plans cater to a wide range of needs. The types of coverage, premiums, and deductibles can vary — which can be confusing.

Consider the following when choosing dental insurance:

Find Out What Plans are Available in Your Area.

Start by narrowing your search to dental plans available in your city and state. Some insurance companies do not offer coverage throughout the United States, so keep things simple by comparing plans available in your area.

Look for a Plan that Has Many Dentists and Dental Practices.

Whether one currently has a preferred dentist or not, it is essential to consider having more than one option. An insurance company that covers many dentists and providers typically remains in good financial standing with a solid reputation — meaning that claims will likely be reimbursed on time.

Consider All Costs.

When searching for a dental insurance provider, patients should first consider the monthly premium and deductible. They should also consider the amount they will have to pay out-of-pocket for dental services (copays) before insurance kicks in.

The maximum annual limit is also essential to note. Most insurance companies put a cap on the amount they will reimburse each year. Once this cap has been reached, all the patient's dental expenses will be out-of-pocket. Patients should pay particular attention if they have extensive dental issues that need to be addressed.

Most routine dental treatments remain covered under dental insurance, but many plans do not cover "extras," such as whitening or sealants. Check with the insurance carrier to learn about covered procedures. Also, be aware that some insurance plans have required waiting periods — leaving patients waiting a long time for coverage on specific procedures — especially the more expensive ones.

“Plenty of options exist for dental insurance. This can be good, as plans cater to a wide range of needs.”

The Value of Dental Insurance

Purchasing dental insurance is a unique experience for everyone. Each patient must assess how much dental work they need, how many family members (if any) will be covered under their plan, and more. Typically, patients who require more dental work and have more family members who need coverage will receive the best value.

Most dental insurance plans cover preventative care (checkups and cleanings) at 100%, basic procedures at 70%, and major procedures at 50%. Since some procedures may be considered basic by one carrier and major by another, patients should speak with their insurance carriers for any necessary clarifications.

“Purchasing dental insurance is a unique experience for everyone.”

Check out what others are saying about our dental services on Yelp: How Does Dental Insurance Work in Rosenberg, TX

Individual vs. Family Dental Insurance

While some patients only need coverage for themselves, others may require coverage for the entire family. Both individual and family dental insurance plans can be purchased through the U.S. government's Marketplace or directly through a carrier. However, premiums for individual plans are typically lower than for family plans, as they involve only one individual.

In contrast, family dental insurance plans generally have higher premiums. However, most allow for two annual exams per plan member. It is essential for patients to find the right type of coverage for them – and, if applicable, their families – that still remains affordable.

“While some patients only need coverage for themselves, others may require coverage for the entire family.”

Questions Answered on This Page

Q. What should I look for when choosing dental insurance?

Q. How can I find dental insurance that takes my ideal dentist?

Q. What is the value of dental insurance?

Q. What are the differences between family and individual dental insurance?

Q. How can I find an affordable dental insurance plan for my family and me?

People Also Ask

Q. What factors should people consider when choosing a dental insurance plan?

Q. What is a health savings account?

Q. Who is the billing specialist?

Choosing Dental Insurance

Purchasing dental insurance can be an overwhelming experience. Luckily for many people, the plan offered by their employer or professional association is the best possible option. Still, in many cases, it may be useful for patients to talk to their dentists to see what plans they accept.

Many dental offices can recommend affordable plans that cover their patients' needs. Patients should look for a policy with a high spending cap if they know they will need major work done, while patients who require less work done can look for a policy with a lower spending cap.

“Many dental offices can recommend affordable plans that cover their patients’ needs.”

Frequently Asked Questions

Q. Can I be covered under multiple dental insurance plans?

A. You may, but one plan will probably be considered your primary plan. If this is the case, the primary plan will go toward your dental care first, with the other plan(s) covering the remaining costs. However, the plans cannot cover more than 100% of the treatment cost.

Q. What are the different kinds of dental plans?

A. Like health insurance plans, dental insurance plans are generally categorized either as Indemnity (e.g., HMO) or managed-care (e.g., PPO) plans. These plans mainly differ in the patient's choice of providers, how expenses are paid, and out-of-pocket costs.

Q. Why is dental health important?

A. Many people mistakenly believe that dental health is isolated from overall health. In reality, each system of the body is interrelated. In other words, neglecting your oral health could easily have disastrous effects on your overall health.

Q. Do I really need a dental insurance plan?

A. Yes. It can be costly to keep up with dental health, especially if you are making your routine checkups and cleanings as directed. Choosing the right dental insurance plan can help keep costs low while promoting proper healthcare.

Q. Whom should I talk to about any questions I have about my dental insurance plan's benefits or a claim?

A. It is best to directly contact your insurance carrier for any questions and concerns about your benefits or claims.

Dental Terminology

Call Us Today

If you have questions about dental insurance options or whether or not a service is covered, call KRB Dentistry in Rosenberg at 832-361-3929 to learn more.

Helpful Related Links

- American Dental Association (ADA). Glossary of Dental Clinical Terms. 2024

- American Academy of Cosmetic Dentistry® (AACD). Home Page. 2024

- WebMD. WebMD’s Oral Care Guide. 2024

About our business and website security

- KRB Dentistry was established in 2014.

- We accept the following payment methods: American Express, Cash, Discover, MasterCard, and Visa

- We serve patients from the following counties: Fort Bend County

- We serve patients from the following cities: Rosenberg, Richmond, Cumings, Pecan Grove, and Pleak

- National Provider Identifier Database (1124126479). View NPI Registry Information

- Healthgrades. View Background Information and Reviews

- Norton Safe Web. View Details

- Trend Micro Site Safety Center. View Details

Back to top of How Does Dental Insurance Work